Generally, when making the case for business preparedness, effective arguments have centered on the potential damage future events will have on facilities, equipment, staff, other assets and operations. Judging what might happen and the impact on future business is an exercise in risk management and requires a significant time commitment, but the payback is clear and valuable.

Perhaps even more important than identifying risks is the planning process that follows which outlines how your organization will respond to possible disruptive events.

Emergency Action Plans

In the United States, the Occupational Safety and Health Administration (OSHA) is chartered with ensuring that everyone has a safe and healthy workplace. One regulation that the Administration enforces is 29 CFR 1910.38(b).[1] This rule requires every business to have an Emergency Action Plan (EAP) which mandates six areas of preparedness that must be addressed. For organizations with ten or more employees, this plan must be written, while smaller organizations can communicate the information verbally.

If your organization does not have a current EAP, consider using the Emergency Action Plan Template that is a component of the Ready Rating™ Program. This planner gives you two options. A streamlined planner which covers all the OSHA requirements (EAPGo), or a more detailed version which is popular among larger organizations (EAPAdvance). [2] By simply answering several questions, the planner will generate a customizable emergency action plan that is easy to maintain and follow. You can even find a “pop-up” on the Ready Rating site that highlights the difference between the two plan versions to help you choose the one that is right for your organization.

Measuring the Impact of Business Risk

In business, risk is defined as the likelihood of a future event happening combined with an estimate of its financial impact. Determining values for both these factors is a subjective process.

While statistics describe the frequency with which many hazards occur, the choice of which threats to consider and their potential impact on operations are judgements that should be discussed openly and periodically reviewed.

To estimate the loss from suspended or reduced operations, ask two questions. What percentage of operations will be shut down? How long will the recovery take? Knowing these two factors makes it possible to calculate operating losses. These answers also establish an upper estimate of how much you should budget for an emergency response since they represent the total potential loss an organization might face in a year if all projected hazards were to occur[3].

Loss of Revenue from Interrupted Operations

Having an emergency plan sends a clear statement that your enterprise takes its responsibility to employees, clients, business partners, and the community seriously. The plan also promotes the firm’s image, may help reduce insurance costs, and can positively impact the organization’s credit standing.[4]

The Growing Importance of Intangibles

In recent years, there has been a shift in attitude toward the importance of intangibles such as an organization’s brand (name and reputation), the value of its processes and other forms of intellectual property.

Studies reviewing the way companies have been valued over the last forty years support this changing mindset. Dr. Margaret Blair of the Brookings Institute has tracked the changing value of intangibles in corporate America. Her research shows that in 1978, eighty percent of an organization’s wealth was concentrated in tangible assets (property, cash, equipment, inventory, etc.). Today eighty-five percent of a firm’s wealth consists of intangibles.[5]

This research helps define the important role that preparedness and enterprise resource planning play in protecting the value-drivers of organizations and should be emphasized when presenting the program to top management.

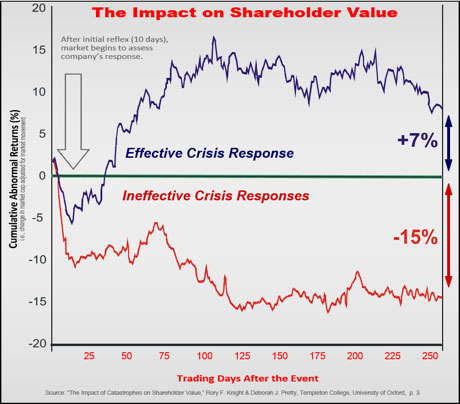

As further evidence of the value of preparedness planning, work done by Rory Knight and Deborah Pretty of Templeton College at the University of Oxford showed the impact that management reactions during a crisis can have on corporate valuation.[6] Their study reviewed the change in stock price of fifteen public-traded companies over a three-year period and traced how management’s ability to clearly and quickly react to a crisis affected share value.

After the initial “shock period,” there was a 22% share price difference between companies where management proactively responded to the crisis versus those that appeared unprepared (7% rise versus 22% drop in share price)[8].

This study proves that well-prepared and thoughtful leadership in a time of crisis pays off.

Since planning takes a commitment of time, resources and management support there is the temptation to put it off. However, the benefits of preparedness planning are clear and measurable.

Using the free tools at the Ready Rating site will reduce the time needed to assess your risks and develop an emergency action plan. In addition to many indirect benefits, having an EAP brings your organization into compliance with OSHA regulations and is a clear sign of management’s commitment to operating a safe and healthy workplace.

For more information on the tools and planning aids mentioned in this article consult the Resource Center.

[1] Details can be found at: https://www.osha.gov/SLTC/etools/evacuation/expertsystem/default.htm.

[3] Business continuity plans cover all aspects of preparedness including emergency response, disaster recovery, restoring operations, and business resumption.

[4] The rating service Moody’s takes the existence of a BCP into account when setting credit limits.

[5] See: https://www.brookings.edu/book/unseen-wealth/

[7] Source: “the Impact of Catastrophes on Shareholder Value,” Rory F. Knight and Deborah J. Pretty, Templeton College, University of Oxford, p.3.

[8] These percentage changes are relative to the change in value of each organization’s share price and is not a comparison between firms.